Investor Intelligence Pilot

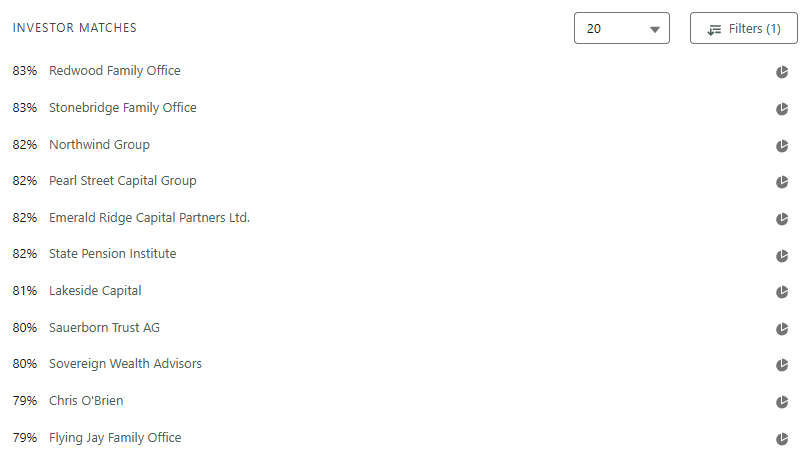

AI-ranked investor shortlists for every fund, with ready-to-use investor summaries from your CRM data.

Request a demoAI-ranked investor shortlists for every fund, with ready-to-use investor summaries from your CRM data.

Request a demo

Connect the right prospects to the right funds.

Identify the next logical fund opportunity for current LPs to expand their portfolio.

Save time digesting interaction data and surface things that could have been overlooked.

We review results with your team and adjust quickly.

Deliverables can be provided as an API, a CRM widget, a report/dashboard, or a small standalone app, depending on what fits your workflow.

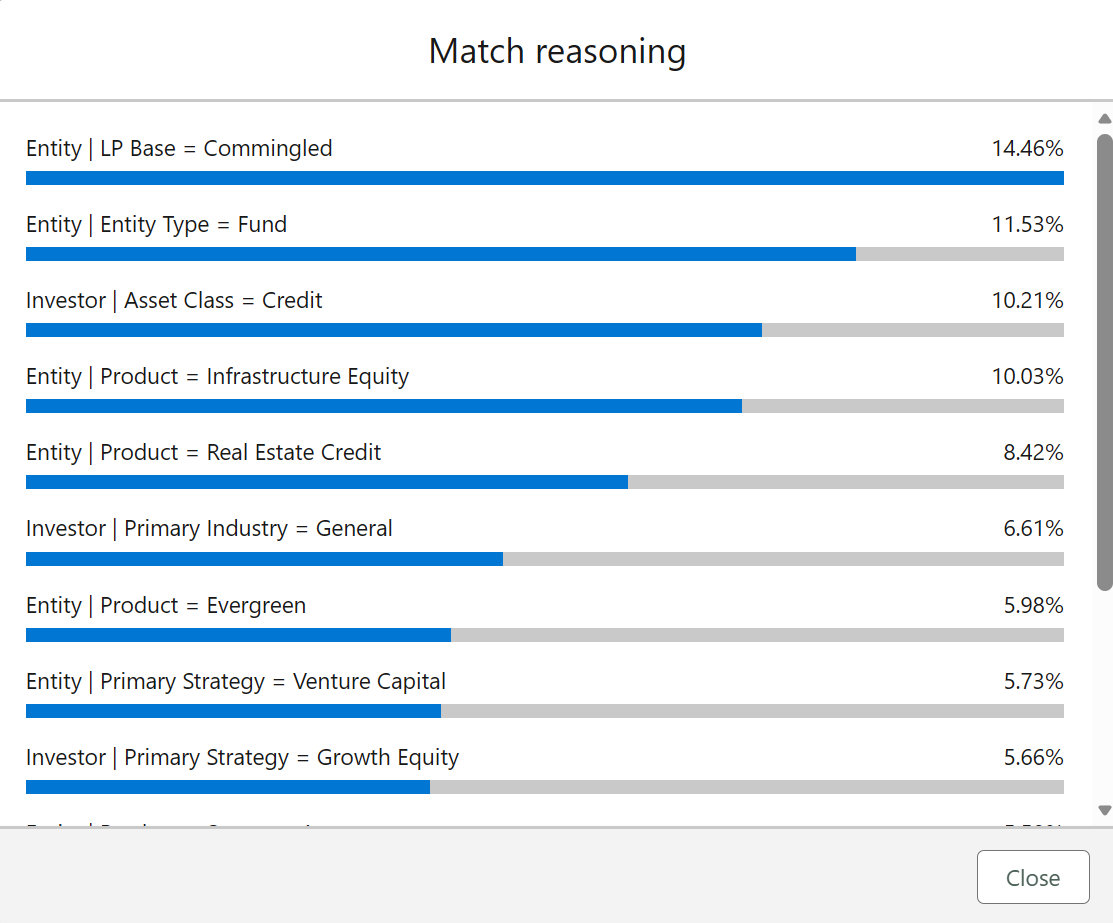

Most matching tools rely on fixed rules someone sets in advance. Those rules can work at first, but they only reflect what you already believe, and they need manual tuning as behavior changes.

Our matching learns from what actually happened in your historical data and adapts as behavior changes, so results keep improving over time.

Like Netflix learns from real viewing behavior to recommend what you will likely watch next, we learn from real investor behavior and history to rank which investors are most likely to be a fit for a specific fund.

CRM accounts and contacts, interactions, notes, emails, meetings, and calls.

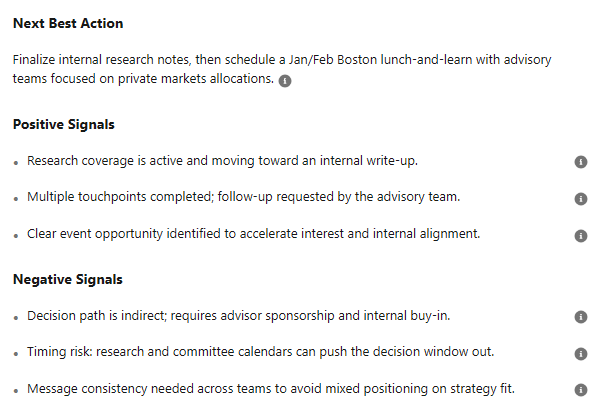

Ranked investor matches for selected funds and investor briefs with clear takeaways.

We adjust ranking and summaries based on what your team says is actually useful.

It works best with structured CRM-style data where investors, entities, funds, and interactions are linked (accounts, contacts, activities, notes).

No. This is a pilot with clear deliverables. It proves value before you commit to anything bigger.

No. You can start with what you have. Cleaning up duplicates and inconsistent fields usually improves accuracy and reduces noise, but it is not required.

As part of the pilot, you get:

No. It speeds up preparation and prioritization. Your team decides who to contact.

If it worked, you can expand to more data sources, and more automation. If it did not, you walk away with clear learnings and pilot outputs.